As 2016 moves into our rear-view mirror, our attentions are moving towards what the new year will hold. Of course, if you are someone who follows politics, you’ve been thinking about 2017 for a while. Years don’t happen in a vacuum. The events of 2016 will leave a mark in 2017, of course they will – but how? And what new elements will be thrown into the mix?

If you are looking at investing in the markets this year, you’ll know that crisis and opportunity are never far apart. Last year saw plenty of the former (and consequently, some of the latter). If you’re thinking about investing in currency, what dates should you be looking at? Who are the people you should be listening to? And which parts of the world are going to be important in 2017?

January: All Change In Washington

You’ll often hear it said about US politics – and geopolitics in general – that every so often there is an election, and the faces at the top change. Even the parties in power may change, but it’s business as usual. This January 20th, that will not be the case. Donald Trump’s win in November, against the will even of many of his party, means all bets are off.

The volatile property magnate has come under constant scrutiny for the last year or so. His actions from this point on could have major implications not just for the US and the value of the dollar. It’s said that when America sneezes, everyone else catches a cold. What will that mean for trading in 2017? It’s fair to say that it’s anyone’s guess.

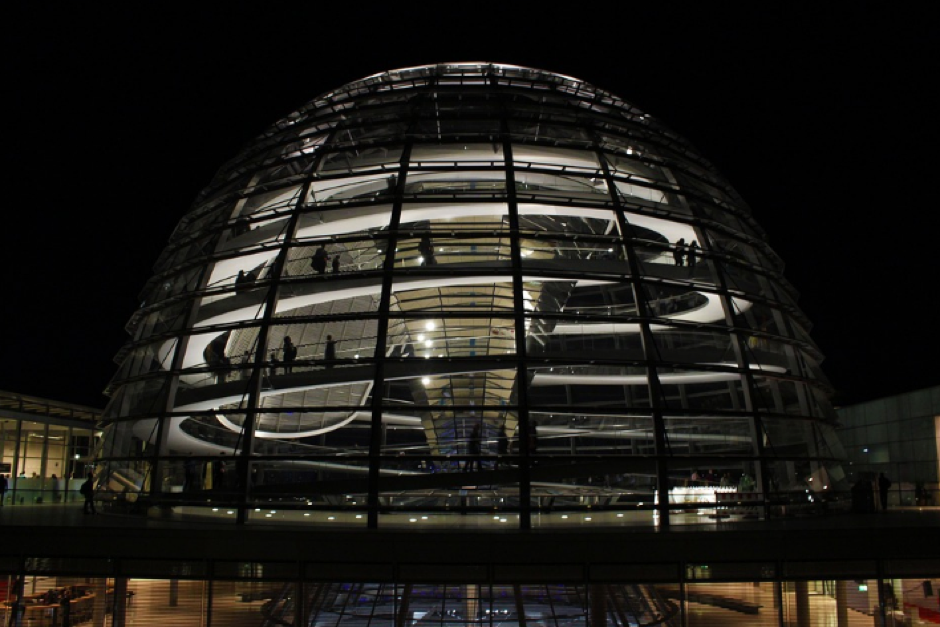

February: Germany Goes To The Polls (I)

The second weekend of February will see German voters go to the polls for the first of two elections in 2017. This time they will be voting for the President of the nation. The sitting coalition government have put forward the SPD’s Frank-Walter Steinmeier as their candidate. He is expected to win, but even if he does, the margin of victory will be seen as a reflection of national mood.

If Steinmeier should lose, or be pushed harder than expected by a candidate from a smaller party, it could have implications for the Euro. Not least because, the following month, there will be moves afoot nearby in Europe.

March: Attention Shifts To London

[ Image Resource ]

[ Image Resource ]

Back in June 2016, voters in the United Kingdom narrowly took a momentous decision to withdraw from the European Union. Issues such as immigration and national sovereignty were posited as driving that decision. How those issues are impacted could take years to unpick.

What happened instantly was a drop in the value of British sterling. In March, the British government is set to trigger the mechanism for leaving the EU. Recent court battles have thrown further questions over their negotiating position. A Parliamentary vote is set to precede this triggering, which may throw some light on the government’s plan.

Any information that emerges around this vote – or the absence of any information – is certain to have implications. These will not just affect sterling, but also the Euro. The smart money is on another drop in sterling, but the pundits have been wrong before. A Dutch general election earlier in the month, which could see populist Geert Wilders elected to power, may muddy the waters.

April-May: Look Towards France

[ Image Resource ]

[ Image Resource ]

No sooner will the bulk of the smoke have cleared from London, than attention shifts to Paris. For many years a friend and rival to the UK in equal measure, France is one country which cannot fail to be affected by Brexit. The national mood is strained. A string of terror attacks in recent years have heralded a shift rightward in the polls.

All of which points to a perfect storm for a populist rightwing candidate such as Marine le Pen, leader of the Front National. Were she to win the election, it really would ignite an already fractious continent and have opportunists running to their regulated Forex broker to speculate on the future of the Euro.

Will she win? It’s thought not – the most likely outcome is that she will advance to the second round and lose to conservative Francois Fillon. But “most likely outcomes” have been flipped on their heads twice in the last twelve months. May the 7th is the date for the second round.

June: France Votes Again

Having voted twice in a fortnight a short while ago, the French public could be forgiven voting fatigue. However in June, they will be at it again, this time voting for their legislative assembly. At the moment the parliament is held by the left. President Francois Hollande’s Socialist Party are currently in possession of most seats. This is not expected to remain the case.

The questions are likely to be: How badly will they lose? And where will their vote go? If the populist Front National make substantial gains … well, by now you know how this story goes.

August – October: Germany Goes To The Polls (II)

There is a three-month window in which the German federal election can happen, but it will be done by October. Incumbent president Angela Merkel is expected to return as Chancellor. The questions at this point circulate more around the strength of coalition that she returns with.

The current coalition is made up of her centre-right CDU and the centre-left SPD with support from the Greens. Meaningful gains for the AfD party, a far-right populist movement, could make governing difficult.

In 2016, some seeds were planted and the mere fact of their planting has had implications for your investments. In early 2017, the first shoots will begin to appear from those seeds. Implications for the dollar, sterling and the Euro mean implications for all other markets. So when planning your investments in 2017, think carefully.

There may be quick, and substantial, gains to be made by defying the pollsters. If 2016 taught us anything, it is that the final opinion polls may be wrong. Do you gamble on the pollsters having learned from recent setbacks? Do you profit from markets following what may be inaccurate polling? It’s up to you – but there are clearly opportunities to profit.